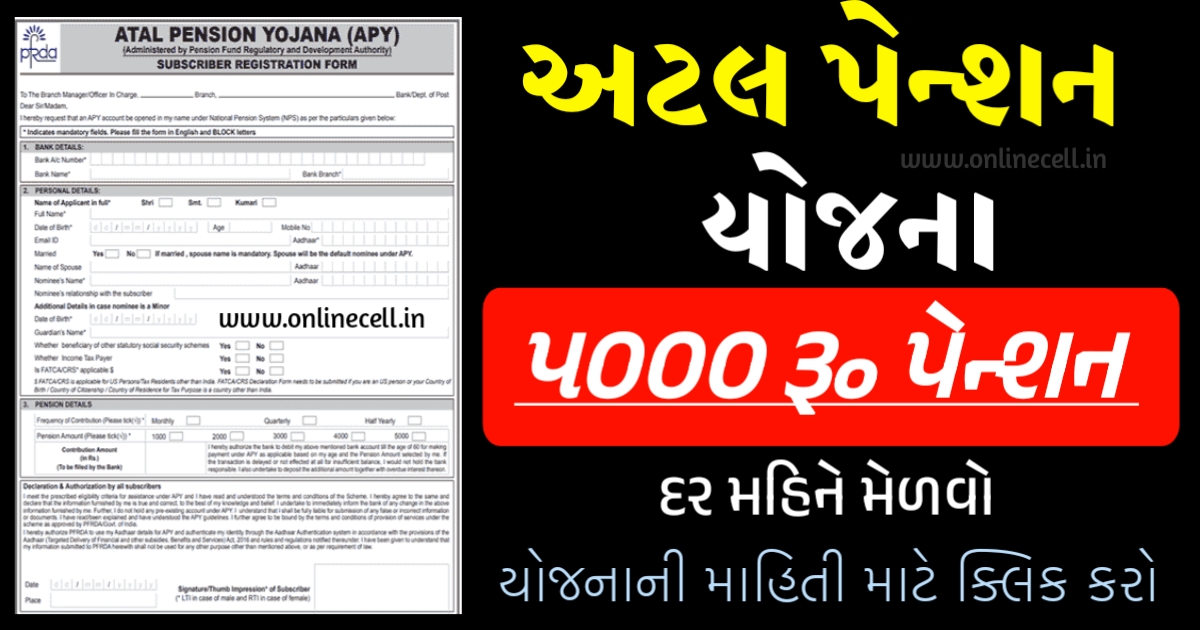

Atal Pension Yojana Detail: Government will give 5 thousand rupees pension every month; pension planning is very important. If you are also thinking of investing in a secure place to protect your retirement plan, then definitely read this news.

Today we are telling you about the government's Atal Pension Yojana (APY), in which husband and wife can get a pension of Rs 6,000 per month by opening separate accounts. There are many other benefits of this scheme (Atal Pension Benefits). Let's know about it.

What is Atal Pension Yojana?

Atal Pension Scheme is a government scheme in which the investment made by you depends on your age. Under this scheme you can get monthly pension of minimum Rs 1,000, Rs 2,000, Rs 3,000, Rs 4,000 and maximum Rs 5,000. This is a safe investment.

Who can invest?

Atal Pension Yojana was launched in the year 2015. At that time, it was launched for people working in the unorganized sector, but now any Indian citizen between the ages of 18 and 40 can invest in the scheme. In this scheme, the depositors start getting pension after 60 years.

Benefits of Atal Pension Yojana

- Income security during old age.

- The objective of this scheme is to invest for voluntary retirement.

- Will be concentrated for unorganized sector workers.

- Implementation will be from 01-06-2015.

- Eligibility: Minimum age will be 18 years and maximum age limit will be 40 years.

- The administration will be done by the Pension Fund Regulatory and Development Authority (PFRDA).

Eligibility of Beneficiary of Atal Pension Scheme

- Atal Pension Yojana (APY) is for all Indian citizens between the ages of 18 to 40 years. To avail this scheme, each individual has to pay the amount prescribed by the government for at least 20 years. Any bank holder who is not a member of any such social security scheme can avail the benefit of this scheme.

- For a monthly pension of Rs.1000/- to Rs.5000/-, the beneficiary will have to pay an age-based contribution of Rs.42/- to Rs.291/-.

- The level of contribution will be related to the age of the individual. A person who joins at a young age will contribute less and at an older age will be more.

- To encourage investment in this scheme, those who open a new account before 31-12-2015 will be credited by the Central Government to the holder at a maximum rate of Rs.1000/- per year or 50% of the total contribution in the account whichever is less. (From 2015-16 to 2019-20) Existing Rashtriya Swavalamban Yojana savers will be automatically transferred to Atal Pension Yojana.

How to get a pension of 5,000 rupees

Husband and wife below 39 years of age can apply in this scheme. If the spouse is 25 years or below, they can contribute Rs 226 per month to the APY account. If the age of husband and wife is 35 years, they have to deposit Rs 543 in their respective APY accounts every month. In addition to the guaranteed monthly pension, if one of the spouses dies, the surviving spouse will get Rs 5.1 lakh per month along with full life pension.

Benefits of the Yojana

Under this scheme people between 18 to 40 years can get their nomination in Atal Pension Scheme. For that the applicant must have a saving account in a bank or post office. You can have only one irrevocable pension account. The earlier you invest under this scheme, the more benefits you will get. If a person joins the Atal Pension Scheme at the age of 18, after the age of 60 he has to deposit only Rs 210 per month for a monthly pension of Rs 5000 per month. Thus, this plan is a good profit plan.

| Important | Links |

|---|---|

| Official Notification | Click Here |

| Official Website | Click Here |

Tax Benefit Yojana

If you pay income tax then you will also get tax benefit in this scheme. People who invest in Atal Pension Yojana get a tax benefit of up to Rs 1.5 lakh under Income Tax Act 80C. In case of premature death of the person belonging to this scheme, his family continues to get the benefit.